Follow us on Instagram by clicking here.

Follow and like the Turtleboy Sports Smiles Forever, the newest Turtleboy Sports page and Clarence Woods Emerson to keep up with the hilarious turtle rider commentary.

Want to advertise with Turtleboy? Email us at Turtleboysports@gmail.com for more information.

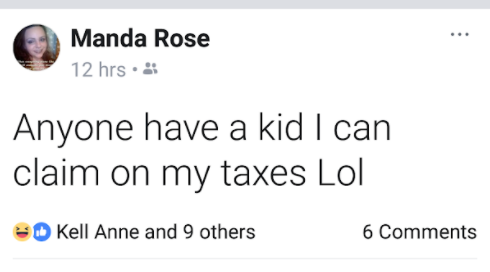

Tax deadline is less than a month away, and down in Lowell they’re exploring creative ways to keep Uncle Sam from taking their money…..

Someone sent this to us and we told them that she’s probably just kidding. Ya know, cuz of the LOL. Turns out she was completely serious:

If your response to someone telling you to spit out a new bang trophy in order to get a tax break is, “good theory, except my man is locked up,” then you most definitely are not above claiming someone else’s kids on your taxes.

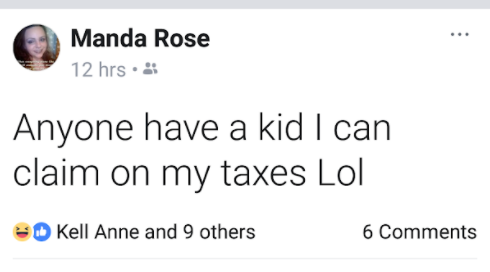

And if this is the person offering to let you claim her children on your tax return if you got 50/50 with her…..

….then you are most definitely not kidding around.

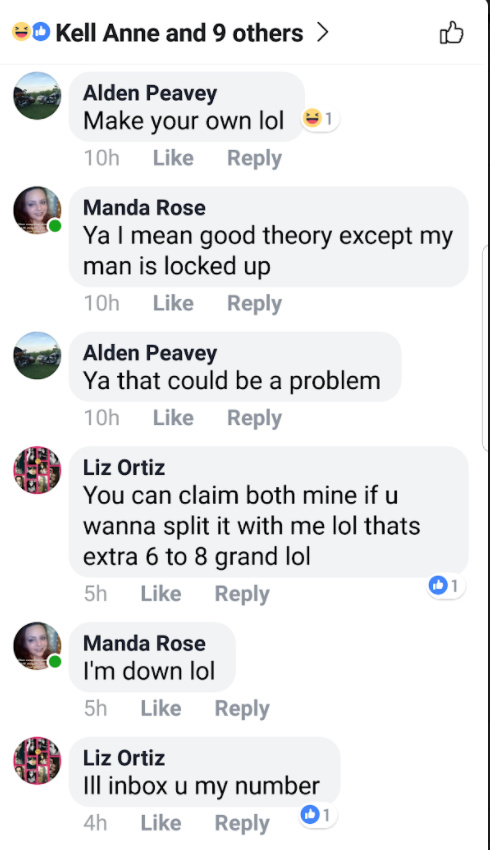

If you were arrested less than 6 months ago for shoplifting in Chelmsford:

You likely have no problem claiming someone else’s kids on your taxes in order to save a few grand.

If you’re a duckface selfie connoisseur

You’ve probably thought long and hard about pulling off a scam like this.

Here’s my question – is it this easy? Can you just claim someone else’s kids on your taxes? Does the paper pusher at the IRS just pass your form along, or do they spend time researching each and every person’s tax return to make sure they have X number of kids living in their ratchet dens? This is like food stamp Friday on steroids!

The bottom line is that if you’re gonna plot to scam the IRS with a fake baby plot while your chudstuffer is locked up, make sure you don’t do it openly on Facebook. Because turtle riders are everywhere and they know how to screenshot.

26 Comment(s)

I know this is an old article, but, I’m bored and just going through some old ones I missed. I used to have a friend who divorced her husband and moved back her and he stayed in the state they were living in, almost 2,000 miles away.

Been almost ten years now, he doesn’t pay support, hasn’t seen his kids once, talks to them on the phone maybe once or twice a year.

She, on the other hand, doesn’t work, has been on welfare, food stamps, Medicaid, pays a whole $4 a month in rent for a three bedroom apartment. All while living with her bf who makes good money, that of course she doesn’t claim lives with her. And did I mention, drives a pretty nice vehicle?

Since she doesn’t work she allows the ex to claim the kids every year, and then they split the money. It is usually about $9,000 total he gets back because he gets to claim head of household, earned income credit, and whatever else the government let’s people claim. So they both walk away with a good chunk of money, while me, and my husband have to pay in every year, this year it was almost $6,000.

I have turned her into her apartment complex, because it is suppose to go by everyone’s income, not just her welfare income. The IRS, the welfare office, and to my knowledge, not not one thing has ever been done.

You would think the IRS would look and see how far away the dad lives and see he doesn’t live anywhere close at all, and hasn’t paid any child support. Therefore couldn’t possibly support them for six months out of the year. But apparently they do not care.

This is why we need to repeal income tax.

What actually happens in MA is you have 2 poor people making 25K.

The State if Massachusetts literally takes about a thousand dollars from one of those people and gives it to the other person so they don’t have to work anymore.

I know it’s a tad more complex than that, but if you really want to both help poor people AND cut fraud and cut tax collection expenses don’t tax anyone one their 1st 50K and don’t allow any deductions.

We shouldn’t have any income tax, the state should get by on land tax alone.

I’m sure a wealthy person might say hey why do all these people making 25K not have to pay their fair share, but think about it. They’re collecting more than they are paying in, Paul Ryan campaigns on that fact. Just end the bureaucracy and cancel welfare and taxes on the poor and let people keep their own money and they will be more interested in working than getting knocked up during a conjugal visit just to get a bribe from the state.

What, this is a thing ppl do?? Lol wow.

As far as i know you can only claim 5 dependants, so anyone with more than that is losing out on dat ca$h muneyz……

I know a shank muffin from Spencer/Webster who claimed someone’s children (non blood relatives to her) several years in a row. She couldn’t claim her own daughter because the grandmother had custody of her. The mother of the kids was on section 8 & collecting welfare. One of those years these kids were residing (out of state) in New Hampshire but the taxes were filed in Mass. I know once she filed threw Liberty & another time she had her sister help her do them them online. I had no problem turning both the idiots into the IRS. I have had legal custody of 2 grandchildren for many years an every tax season I have to jump threw hoops to prove I am their guardian/sole supporter. So, tell me how these leeches can just walk off the street claim all these so called dependents & be handed thousands of dollars? AND then to see some lowlife fraud queens post it on social media just pisses you off!

The white apologists tell white people they shouldn’t be racist.

The white non-apologists then see this fucking article, then watch the news every single night, then live next to someone or know someone or maybe they have had the tires stolen off their cars which was left on milk crates, then see illiterate alien assholes taking off from accidents because they’re driving uninsured vehicles and can’t read street signs while driving over the speed limit down a highway, then see spray graffiti all over fuck’s creation, then MOST OF ALL see white people getting assaulted FOR BEING WHITE when they wander into the wrong neighborhood…

With all of this going on in the background, the white non-apologist looks right at the white apologist, slaps a magazine into his Sig Sauer P320, and says:

“Duck, asshole.”

Old Liz ORiz looks like she has a family going on, why in the fucking world would she not be claiming her own kids? OK, maybe she don’t work, but that “boo” of hers should be, and let him claim them? Unless of course, she cannot trust the very man that is around her kids. Seems like a farked up convo, they gots to be joking around, no one can be that stupid. Can they? lol/

When I claim my own son I have to prove he lives with me .. I think it used to be that easy but not anymore .

Urban Democrats constantly prove they’re America’s tapeworms.

Why wouldn’t the woman who actually HAS the kids want to claim them for herself? Unless maybe she is not filing taxes at all. Cuz they can’t both claim the same kids. My ex-wife and I did that by mistake one year and the IRS picked up on it.

I worked with a guy named Rodríguez from Lawrence. He has NINE CHILDREN. Of course he doesn’t live with them. Has the cash to fly to PR every year. I don’t know how many different mothers, but I’m sure they get everything they need from DTS.

EmfnT,

If the “mother” isn’t working or already has too many kids to claim or would otherwise benefit from letting someone else use the kid, they will do it. I’ve seen it done many times.

I guess while I am at the irs office today PAYING my tax bill I can find someone interested in a screen shot. They shove it up my ass I will gladly pass on the favor. #snitchesBEbitches

#facks

I don’t see this working. My oldest son moved out several years ago and I claimed him as a dependent. The IRS flagged it and told me I could not claim as he had already claimed himself. I am fairly sure they would do the same thing on dependents because in order to claim them thy have to have a valid SS number.

It works as long as nobody else is claiming the same ss#. If someone doesn’t file taxes then their potential deductions and credits including dependents could potentially be claimed by someone else. Poor people are at low risk for ever being audited.

These fucking shitbags do this all the time. And who gets shafted? Those of us who actually PAY taxes, and don’t cheat on our taxes because we actually have something to lose.

I knew a guy who writes off all his nieces and nephews that are not dependents and said he gets about $20K BACK. He wasn’t a friend, and I tried reporting it on the fraud tip-off page, and nothing was done. They probably saw that his last name was Rodriguez and didn’t want to be “racist”.

Unfortunately, the people who are supposed to stop all this fraud are lazy piece-of-shit state and federal workers who only get their undies in a twist when someone with seizable assets cheats the system.

We live in a system where it’s easy to live off the sweat of others, and when those working people complain, they’re just being “bigots”.

The other big one is the single parent scam.

Know any Puerto Rican men with 7 kids and a wife at home? Probably isn’t legally his “wife”. She claims single struggling parent, and he puts the child support right back into his own pocket.

Tax returns are often filed in the US so that refunds get paid out to people living in PR. As a bonus because the scammers appear to be living in the US they can also vote in local, state, and federal elections.

Too bad PR is a part of the United States….

I’ve taken the liberty of forwarding this to the IRS

JoeFriday,

Shoot – I did too. I hope we’re not sending them too much email. I mean, if one of us sent them the message, then surely they’ll take care of it. They don’t need EVERYONE making noise about the absurdity and criminality of her actions.

About 2 years ago I took a “loan” against one of my IRA accounts for home renovations. I was dumb (wasn’t paying attention) and didn’t pay the full taxable/penalty amount and was slammed with a 5k bill last year. They then dinged me for another $17.13 for interest.

So, I’m ALWAYS in awe (not really) of these criminals that get away with this shit and brag about it. When I was on the phone with the IRS to figure out where I went wrong (totally my fault), they were complete assholes and I finally had to say, “Hey, I’m not trying to screw you over. I made a mistake and I’m trying to fix it.”. The woman on the phone simply said, “You should have known.”.

Dinks.

Don’t you have to have a job to file taxes?

I’m skeptical that she’s employable.

Stan: No you don’t. You can even take an EIC and child credits and end up getting back more than you even paid in.

Yes you do! You neef to have EARNED INCOME FOR EARNED INCOME CREDIT!! You can’t just sit back and not work all year and them get money back! You qualify for no tax status. Also, if they are on welfare (unemployed) none rise can claim their children because massachusttes will pick up on it, maybe not feds, but they are a connected state agency to the irs in general so people are getting a check (legal with taxes) then claiming welfare. They will find, but let then do it,. Someone will find out! Don’t rat them out yet! They’re turtleboy famous note and won’t do it. The irs can’t do anything unless it had already happened. But you put her on blast too early do now she won’t do it.

Unfortunate taxpayer,

You can still get taxes back on SSI (welfare) and SSDI (disability) if you select to have your taxes taken out ahead of time. I know, I have family members that get SSI or SSDI and don’t work and they still get tax return every year. The ones with kids get WAY more, too. So no, you don’t have to work to get a tax return.

Stan the Man,

No, you don’t have to work to get a tax return. People on SSI or SSDI can get a tax return if they opt to have their taxes taken out monthly. People on SSI (welfare) or SSDI (disability) with kids that don’t work can actually get a bunch of money, I’ve seen it happen many times. Our system here in Mass does nothing but reward people who don’t want to work and just hurts the hardworking civilians.